So

04

Sep

2022

Immobilienmarkt in guter Verfassung

Der Italienische Immobilienmarkt holt auf

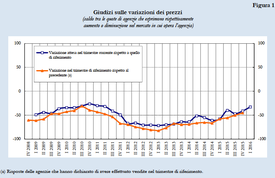

Die italienische Zentralbank macht regelmässig Umfragen bei den Immobilienmaklern, um die Lage auf den Immobilienmärkten zeitnah abbilden zu können.

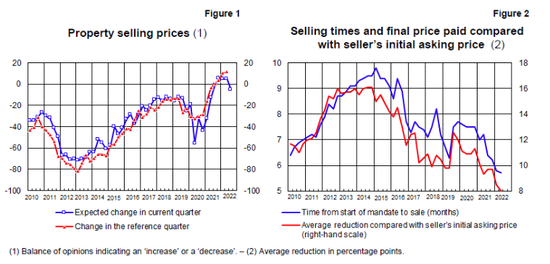

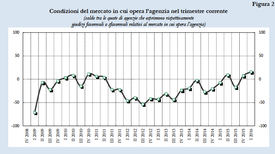

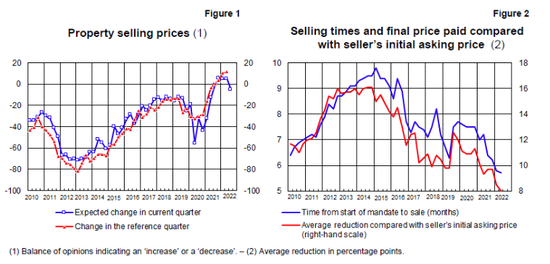

Sie fragt dabei die tatsächlichen Immobilienpreise und die erwartete Entwicklung im laufenden Quartal ab - siehe linke Grafik. Auf der anderen Seite fragt sie nach der Zeit, die nach der eine Immobilie verkauft wird, und nach dem durchschnittlichen Abschlag im Vergleich zum ursprünglichen Angebot. Die beiden letzteren Daten sind Indikatoren über die Marktverfassung - bei erhöhter Nachfrage sind bei beiden Indikatoren tiefere Werte zu erwarten.

Die beiden Grafiken zeigen, dass sich die Immobilienmärkte nach kurzem Einbruch am Anfang der Covid-Pandemie relativ rasch wieder erholt und sogar deutlich gefestigt haben. Die wirtschaftlichen Unsicherheiten - durch den Krieg in der Ukraine und die globalen wirtschaftlichen Verwerfungen ausgelöst - hatten bis jetzt noch keine deutlichen Spuren hinterlassen. Allerdings sind gewisse Schwächtetendenzen durchaus zu erwarten.

Für interessierte Käufer lassen sich derzeit Gelegenheiten für Investitionen identifizieren - insbesondere für Schweizer Käufer, die durch die Frankenstärke einen Wechselkursbonus geniessen dürfen.

RTB/4 Sep 2022

Quelle der Grafik: Banca d'Italia.

Di

08

Nov

2016

New Data on Tuscany

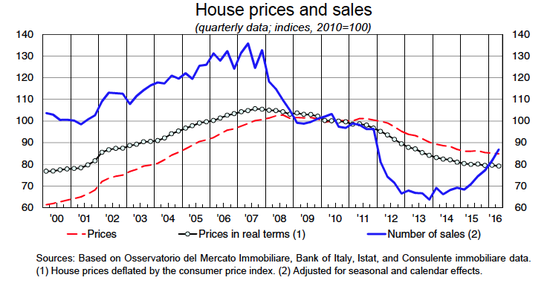

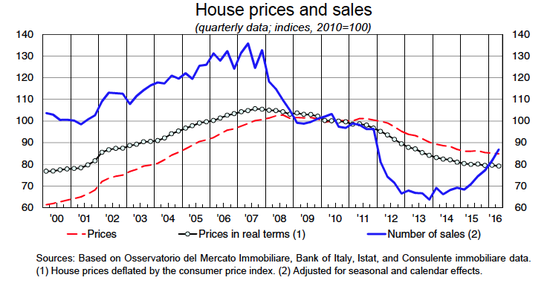

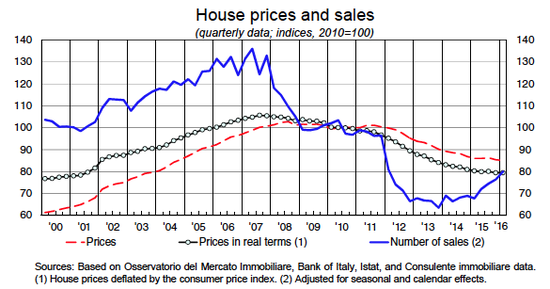

Today, the Italian central bank published its annual report on the economy of Tuscany. Regarding the real estate market, the Banca d'Italia presented the chart included above - showing that the house sales in Tuscany increased quite dramatically in the second half of 2015 and the first half of 2016. This growth was certainly higher than in other parts of the nation, as we know from other statistics.

Yet, the Banca d'Italia also reported that the Tuscan house prices, on average, still dropped - by two percent - in the past half year. However, regarding the more than twenty percent rise of sales, this price decrease, in my view, will not last any longer.

R. T. Boeni, 8 November 2016

Di

11

Okt

2016

Property transaction numbers continue to rise

The statistics of the Banca d'Italia published today confirm again that the number of real estate transactions continue to increase. You can look at the rise also by consulting my oder blog contributions. Indeed, also my own experience tells me that the interest in Italian real estate has risen, particularly over the past 12 months.

While prices have not yet risen on average, the odds are, I believe, that those will rise the next 12 months...

In Tuscany, there are still very interesting offers, also in the case of extraordinary real estate, wineries, farmhouses, etc..

Rolf T. Boeni

11 October 2016

Mo

12

Sep

2016

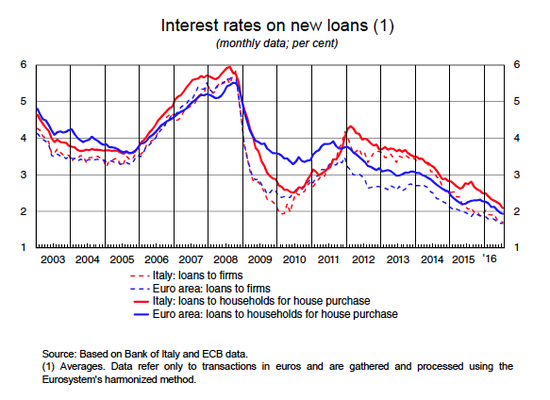

Record-low interest rates support the real estate market

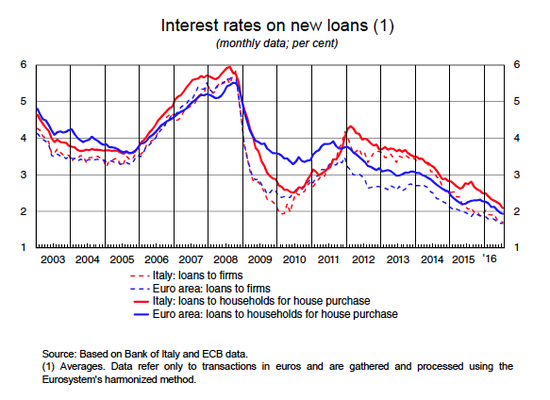

Like in other European countries - the dynamic forces of the economy are also weak in Italy. The growth of the gross domestic product will, according to many official forecasts, continue to be just in the 1% to 1.5% area for the next 1 1/2 years. Not exactly an exiting outlook. Not exactly an outlook that promises major impulses for financial investment and real estate markets.

The other side of the coin, however, is the low inflation - with consequences also on the interest rates. These are on a level that one has not seen in Italy in the past!

The interest rate level is thus one of the few forces that keep the property market lively! The low interest rates may also give the Italian banking sector some space to recover. At least, as it becomes visible on statistics of the Banca D'Italia, the reduction of lending to the private households has been stopped; bank lending is again in the positive area since the beginning of the year.

Thus, we expect that the recovery of the real estate market, as depicted in the graph on prices and turnover, will at least slowly continue.

Rolf T. Boeni

Mi

15

Jun

2016

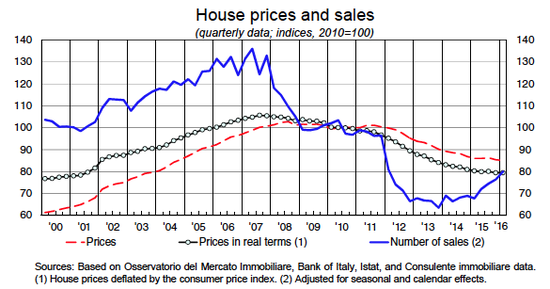

Again: positive direction confirmed

The Bank of Italy confirmed again the positive economic data on Tuscany. As usual, one part of the data was on the status of property prices. Also here, the turn into the positive direction is visible. The chart shows clearly that the number of transactions (left) are on the rise - actually since 2014 - and the the prices (right) have turned as well.

Interesting detail: the difference of property prices between city centers and the country side is much much much less than in other parts of Italy. Which means that country houses in Tuscany are very much in demand!!

Sa

20

Feb

2016

Tuscan real estate remains my preferred investment. Good time to buy!

The Bank of Italy just published the latest results of her brokers’ survey about the conditions on the real estate market. This is a quarterly survey on the brokers’ experience in the past quarter and their expectations about the development of the demand and prices.

In short, the results again confirm that the moderate recovery is continuing. Notable is that for the first time since the third quarter of 2010 the balance of the expectations regarding the evolution of the national real estate market is significantly positive (8.1 percentage points against about

zero in the previous survey). What’s more, optimism for the medium term (two years) has increased: the share of expectations of improvement has increased to 55.9 percent (from 53.1 in October), against a decrease of those expecting stability, and of those expecting a deterioration (from 12.1 to 10.5 percent).

OK - while the real estate broker may generally be more optimistic than pessimistic - like stock market analysts - it is nevertheless evident (also if seen over the longer period) that the real estate market has definitely improved.

Again, my conclusion, a good time to buy! In particular - and this is even more important - as very attractive properties are available on the market.

NB: Dear stock market investors: The survey also shows that it is definitely wrong to say that the private real estate market offers just emotional return and not much more. Rather, what is evident is that the private real estate market in the recent past offered a much higher return that the stock market. And - I would like to underline - the emotional return comes in addition, is MUCH HIGHER …. and remains untaxed!!

Judgments about price changes

(Balance between the agencies expressing a price increase or decrease, respectively, in the market in which the agency works)

Source: Bank of Italy

Judgements about market conditions in the current quarter

(Balance between the agencies expressing favorable or unfavorable judgments respectively relative to the market in which the agency works)

Source: Bank of Italy

Prices may be at their turing point

The latest data of the Banca d'Italia indicate that the property prices may be at their turning point or already beyond: The demand is rising and the outlook - in the eyes of the professionals of this market - are turning up again.

See: "Sondaggio congiunturale sul mercato delle abitazioni in Italia aprile 2015, n. 25" published today.

Mi

15

Jun

2016

Again: positive direction confirmed

The Bank of Italy confirmed again the positive economic data on Tuscany. As usual, one part of the data was on the status of property prices. Also here, the turn into the positive direction is visible. The chart shows clearly that the number of transactions (left) are on the rise - actually since 2014 - and the the prices (right) have turned as well.

So

04

Sep

2022

Immobilienmarkt in guter Verfassung

Der Italienische Immobilienmarkt holt auf

Die italienische Zentralbank macht regelmässig Umfragen bei den Immobilienmaklern, um die Lage auf den Immobilienmärkten zeitnah abbilden zu können.

Sie fragt dabei die tatsächlichen Immobilienpreise und die erwartete Entwicklung im laufenden Quartal ab - siehe linke Grafik. Auf der anderen Seite fragt sie nach der Zeit, die nach der eine Immobilie verkauft wird, und nach dem durchschnittlichen Abschlag im Vergleich zum ursprünglichen Angebot. Die beiden letzteren Daten sind Indikatoren über die Marktverfassung - bei erhöhter Nachfrage sind bei beiden Indikatoren tiefere Werte zu erwarten.

Die beiden Grafiken zeigen, dass sich die Immobilienmärkte nach kurzem Einbruch am Anfang der Covid-Pandemie relativ rasch wieder erholt und sogar deutlich gefestigt haben. Die wirtschaftlichen Unsicherheiten - durch den Krieg in der Ukraine und die globalen wirtschaftlichen Verwerfungen ausgelöst - hatten bis jetzt noch keine deutlichen Spuren hinterlassen. Allerdings sind gewisse Schwächtetendenzen durchaus zu erwarten.

Für interessierte Käufer lassen sich derzeit Gelegenheiten für Investitionen identifizieren - insbesondere für Schweizer Käufer, die durch die Frankenstärke einen Wechselkursbonus geniessen dürfen.

RTB/4 Sep 2022

Quelle der Grafik: Banca d'Italia.

Di

08

Nov

2016

New Data on Tuscany

Today, the Italian central bank published its annual report on the economy of Tuscany. Regarding the real estate market, the Banca d'Italia presented the chart included above - showing that the house sales in Tuscany increased quite dramatically in the second half of 2015 and the first half of 2016. This growth was certainly higher than in other parts of the nation, as we know from other statistics.

Yet, the Banca d'Italia also reported that the Tuscan house prices, on average, still dropped - by two percent - in the past half year. However, regarding the more than twenty percent rise of sales, this price decrease, in my view, will not last any longer.

R. T. Boeni, 8 November 2016

Di

11

Okt

2016

Property transaction numbers continue to rise

The statistics of the Banca d'Italia published today confirm again that the number of real estate transactions continue to increase. You can look at the rise also by consulting my oder blog contributions. Indeed, also my own experience tells me that the interest in Italian real estate has risen, particularly over the past 12 months.

While prices have not yet risen on average, the odds are, I believe, that those will rise the next 12 months...

In Tuscany, there are still very interesting offers, also in the case of extraordinary real estate, wineries, farmhouses, etc..

Rolf T. Boeni

11 October 2016

Mo

12

Sep

2016

Record-low interest rates support the real estate market

Like in other European countries - the dynamic forces of the economy are also weak in Italy. The growth of the gross domestic product will, according to many official forecasts, continue to be just in the 1% to 1.5% area for the next 1 1/2 years. Not exactly an exiting outlook. Not exactly an outlook that promises major impulses for financial investment and real estate markets.

The other side of the coin, however, is the low inflation - with consequences also on the interest rates. These are on a level that one has not seen in Italy in the past!

The interest rate level is thus one of the few forces that keep the property market lively! The low interest rates may also give the Italian banking sector some space to recover. At least, as it becomes visible on statistics of the Banca D'Italia, the reduction of lending to the private households has been stopped; bank lending is again in the positive area since the beginning of the year.

Thus, we expect that the recovery of the real estate market, as depicted in the graph on prices and turnover, will at least slowly continue.

Rolf T. Boeni

Mi

15

Jun

2016

Again: positive direction confirmed

The Bank of Italy confirmed again the positive economic data on Tuscany. As usual, one part of the data was on the status of property prices. Also here, the turn into the positive direction is visible. The chart shows clearly that the number of transactions (left) are on the rise - actually since 2014 - and the the prices (right) have turned as well.

Interesting detail: the difference of property prices between city centers and the country side is much much much less than in other parts of Italy. Which means that country houses in Tuscany are very much in demand!!

Mi

15

Jun

2016

Again: positive direction confirmed

The Bank of Italy confirmed again the positive economic data on Tuscany. As usual, one part of the data was on the status of property prices. Also here, the turn into the positive direction is visible. The chart shows clearly that the number of transactions (left) are on the rise - actually since 2014 - and the the prices (right) have turned as well.